Building Scalable ReactJS Fintech Apps: Best Practices and Next-Gen Features

By the end of this article, you’ll understand why ReactJS is a top choice for financial applications, how to apply proven design and security patterns, and which emerging AI-driven modules you can layer in to stand out.

Why ReactJS Fits Fintech Needs

ReactJS shines in fintech because it lets you deliver fast, interactive experiences while keeping codebases maintainable—its virtual DOM diffing ensures quick UI updates and efficient rendering.

Interactive single-page interfaces for dashboards and portals

Component-based architecture for consistent UIs and faster development

Large ecosystem of libraries for charts, forms, authentication

Cross-platform strategy with React Native for mobile apps

Feature | Benefit |

|---|---|

Interactive single-page interfaces for dashboards and portals | Enables seamless user experience and real-time data updates |

Component-based architecture for consistent UIs and faster development | Promotes reusability and rapid iteration, ensuring design consistency |

Large ecosystem of libraries for charts, forms, authentication | Empowers developers with rich, ready-made functionality |

Cross-platform strategy with React Native for mobile apps | Expands reach with shared codebase for web and mobile platforms |

Statistic: I n the 2023 Stack Overflow Developer Survey , 40.14% of respondents said they work with React.

Core Design Principles

UI/UX and Component Reusability

Craft modular, accessible components—buttons, form fields, tables—by following the WAI-ARIA guidelines so your team can assemble new screens in hours, not days. A style-guide–driven approach also keeps the visual language consistent across web and mobile.

Performance and Scalability

Aim for minimal bundle sizes and fast loads:

Use code-splitting techniques with `React.lazy` and dynamic `import()`

Memoize heavy components using `React.memo` and `useMemo`

Leverage server-side rendering (SSR) frameworks like Next.js for initial load speed and SEO

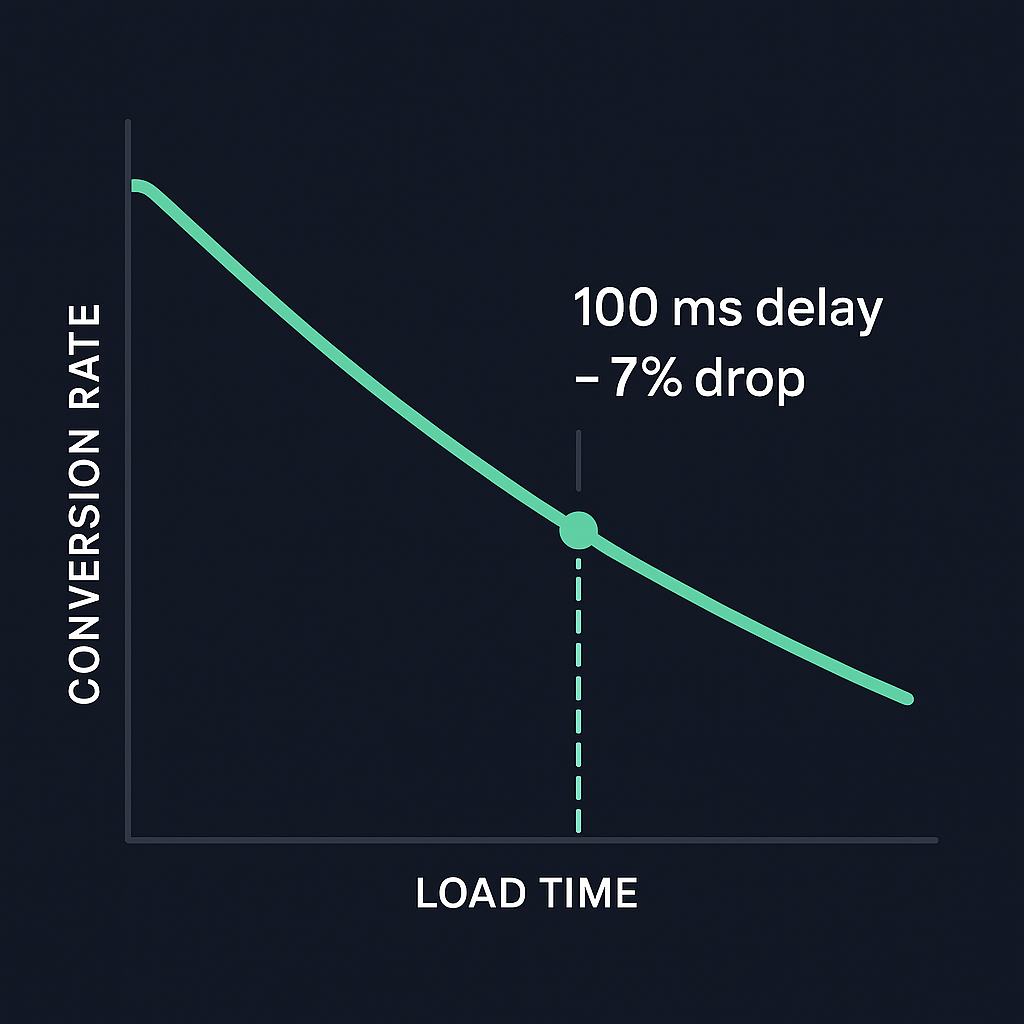

According to Google, every 100 ms of delay in load time can reduce conversion by 7% .

Ensuring Security and Compliance

Security is nonnegotiable in fintech. Implement these basics:

HTTPS everywhere—serve all assets over TLS.

Content Security Policy—restrict sources for scripts and styles.

Token management—store JWTs in HTTP-only cookies.

Input validation—always sanitize user inputs on client and server.

Audit trails—log client-side events for forensics.

Advanced Features for Next-Gen Fintech Apps

Beyond the basics, you can give your ReactJS fintech apps a competitive edge by integrating AI-driven capabilities right into the front end.

Integrating AI-Driven Modules

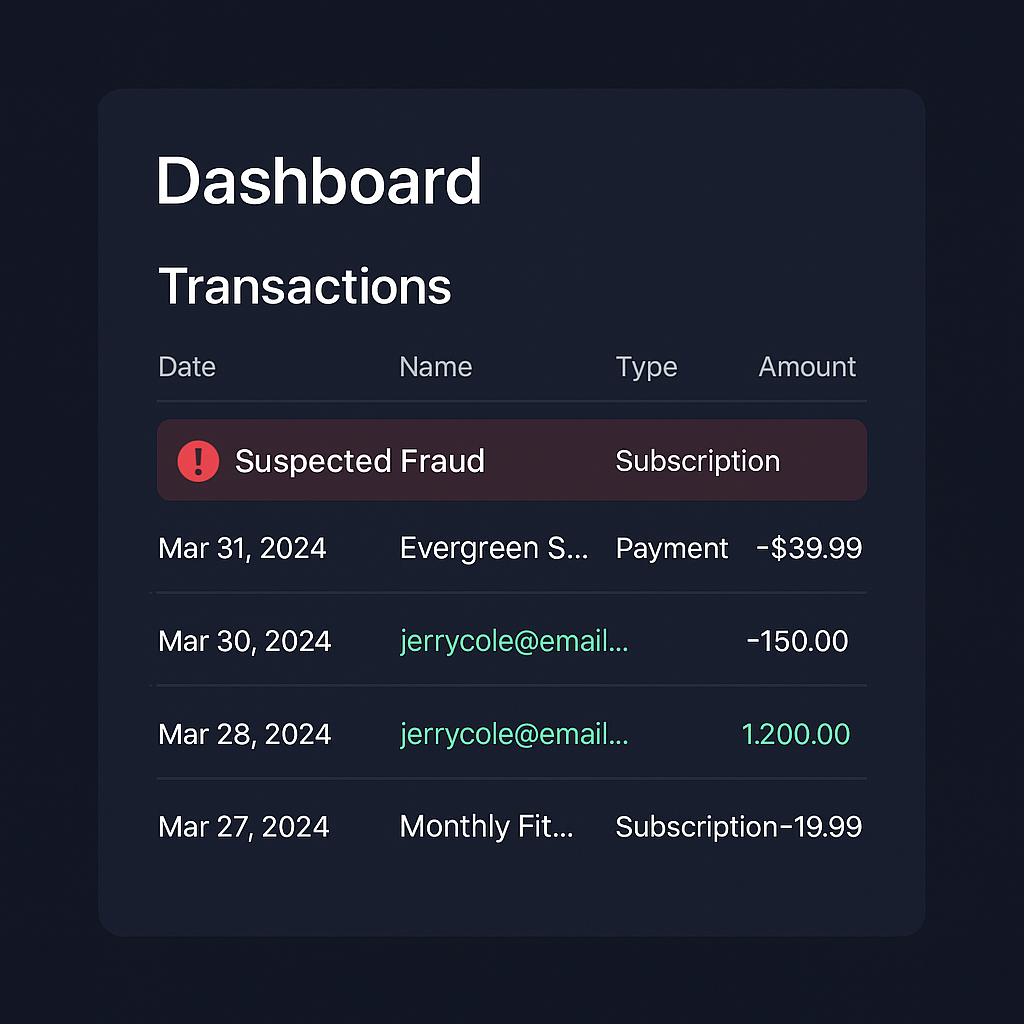

Embed real-time fraud detection widgets that flag suspicious transactions as users type, using lightweight ML models served via TensorFlow.js .

Generative AI for Automated Compliance

Use GPT-based agents to draft regulatory reports, spot anomalies in trading logs, and highlight policy breaches before they reach a compliance officer, leveraging insights from McKinsey on generative AI in financial services .

Conversational Banking Interfaces

Build chat or voice assistants powered by generative AI. Customers get instant answers on balances, payment status, or personalized budgeting tips—without leaving the app—using platforms like IBM Watson Assistant .

Synthetic Data for Rapid Prototyping

Generate realistic but fake customer ledgers and transaction histories using GANs or VAEs. Test new features or simulate market volatility while keeping real PII safe, as demonstrated in recent synthetic data research .

Visualizing Alternative Credit Scores

Design UI components that show credit risk based on non-traditional data—mobile-payment history, utility bills, or even social indicators. This helps banks serve users who lack a conventional credit footprint, supported by findings from the CGAP on alternative data and credit scoring .

The Road Ahead

ReactJS gives you a solid foundation for fintech apps, and AI modules let you differentiate. By combining reusable UI patterns, performance tactics, strict security measures, and cutting-edge AI integrations, you’ll create platforms that delight users today and adapt to tomorrow’s challenges.

:format(webp))

:format(webp))

:format(webp))

:format(webp))